Why Market Multiples Matter

Market multiples, a cornerstone of valuation analysis, provide crucial insights into the shifting dynamics of equities and businesses. These ratios are used to compare a company’s financial metrics, such as earnings or revenue, to its enterprise or market value. When used correctly, they can serve as a quick reality check to support investment and financial decisions.

With the global financial landscape remaining turbulent entering the second half of 2024, a retrospective analysis of recent market trends and performance can be valuable to decipher the likely market trajectory.

Helping to put some of the geographic variations into context, Singapore firm CLA Global TS takes a deep dive into industry-specific market multiples from 1H2023 to 1H2024 reported in Southeast Asia. Here, robust domestic demand, fueled by a tight labor market and stable prices, combined with a resurgence in tourism and export growth, were some of the more significant events that underpinned sustained economic expansion during this period. Click here for the firm’s full report.

What is evident from this detailed research is Southeast Asia's emerging economies have shown resilience in recovering from the Covid pandemic. However, the ongoing geopolitical tensions and their repercussions on global food and energy markets has tempered growth momentum in the region. Disruptions in the supply of commodities has inevitably cast a shadow over the region's development trajectory.

EV/EBITDA ration

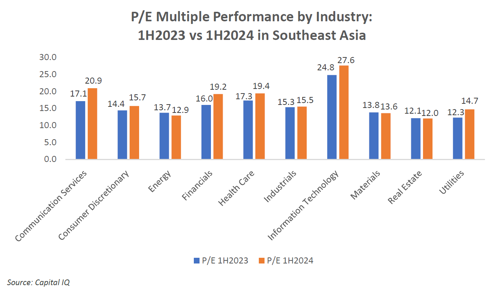

This market multiple compares a company's Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA). Across all the industry sectors in the Southeast Asia region, EV/EBITDA and P/E multiples generally reported increases between 1H2023 and 1H2024.

A closer examination of EV/EBITDA multiples reveals on average a balanced picture, with more granular analysis indicating a relatively even distribution of performance across industries. Specifically, five sectors witnessed improvements in their EV/EBITDA multiples, while another five experienced declines over the 12 months.

A notable surge in P/E multiples was observed across a broad spectrum of Southeast Asian industries. Sectors such as communication services, financials, and utilities experienced significant increases of 22.2%, 20.0%, and 19.5% respectively. This upward valuation trend can primarily be attributed to the region’s sustained GDP growth trajectory, with the resurgence of tourism being the key catalyst in most markets.

P/E rations by country

Local country dynamics also provide valuable insight and can indicate sectors where analysts are forecasting higher earning potential and rising opportunities.

For example, further analysis of regional multiples reveals an overall increase in P/E Multiples for most industries. Notably, information technology and financial in the Philippines contributed to a high median rise of P/E multiples of 35.3x and 26.3x respectively.

Additionally, Thailand’s median multiples in communication services, consumer discretionary, energy and health care sectors performed stronger than other Southeast Asian countries.

Investment optimism was further reinforced by Malaysia, Vietnam, and Indonesia contributing high P/E median multiples in industrials (18.1x), materials (16.6x), real estate (19.9x) and utilities (19.7x).

A surge in information technology P/E multiples globally can be attributed to the current value of technology stocks. With profit margins currently averaging 26%, more than double the levels seen in 2004, the enhanced profitability typically reflects the maturity and evolution of the global technology industry.

In context, digitalization, efficiency and the security of technology systems are cited as the primary drivers behind this P/E surge in countries like Malaysia, Vietnam, and the Philippines. As with many governments globally, there’s a significant focus on developing digital, IT and AI infrastructures.

Conversely, the macroeconomic situation, rising costs, combined with accelerated energy demand has had a more negative impact on energy stocks. The Philippines is a good example of how soaring power demand driven by population growth and economic activity is currently outpacing the country's ability to supply clean, reliable energy. Continued dependence on coal for energy generation, coupled with vulnerability to natural disasters, poses a substantial obstacle to fulfil the country’s energy needs. It has resulted in the median P/E multiple dropping drastically between 1H2023 and 1H2024.

The financial sector is another cyclical business impacted by economic uncertainties. Fall in values can often arise when inflation increases along with interest rates. “In the Philippines, a substantial decline in the finance median P/E multiple is indicative of the country’s general economic slowdown, which has reduced profitability for financial institutions. Lower economic activity results in decreased borrowing, investing and spending, all of which can impact earnings in financial institutions. Additionally, raising interest rates to combat inflation has squeezed the margins of financial institutions more, leading to reduced loan demand and higher default rates,” explains Ms. Grace Lui, Co-advisory leader, Director, Valuation, Transaction Services & Outsourcing at CLA Global TS.

IPO snapshot

The general health of the IPO market in a country can be suggestive of a strong economic future. Globally, IPO volumes fell slightly between throughout 2023, with a significant decline in unicorn IPOs. While the US attracted significant cross border IPOs in 2023, the picture in Asia Pacific was more mixed.

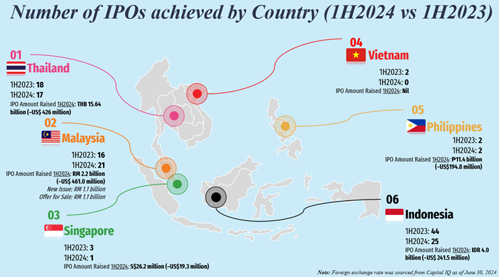

Comparing IPO activities during the first half of 2023 and 2024 reveals a divergent performance across Southeast Asia, notes the latest CLA Global TS report. Malaysia bucked the regional trend with an increase of five IPOs, while the Philippines maintained a steady pace with two IPOs in both periods. The remainder of Southeast Asia experienced a notable decline, with complete absence of listings in Vietnam during the first half of 2024.

Vietnam's IPO drought can be attributed to a confluence of factors, such as tightening of the listing approval process coupled with a surge in foreign investor withdrawals. Global economic uncertainties and domestic market conditions has significantly curtailed IPO activities in Vietnam. Facing these adverse market conditions, many IPO-bound companies have deferred listing plans to await more opportune market circumstances.

“An IPO provides various benefits, such as generating significant capital for expansion and debt reduction, enhancing the company’s visibility and credibility, and offering liquidity to existing shareholders. It also ensures a transparent market valuation, aids in attracting top talent through equity incentives, and improves the company’s financial stability and borrowing potential,” explains Ms. Lui

“Overall, rising inflation, supply chain bottlenecks, and escalating geopolitical conflicts have combined to dampen global economic growth. These headwinds have created an uncertain environment for the Southeast Asian IPO market in the latter half of 2024 and throughout 2025. The future market trajectory will be dependent on government policies fostering growth, domestic political stability, and sustained foreign investment,” she concludes.

For a fuller summary, CLA Global TS publishes a detailed annual report of market activities in Southeast Asia. Click here to download the latest report.

For further information

Ms. Grace Lui

Co-advisory leader, Director, Valuation, Transaction Services & Outsourcing

CLA Global TS

https://www.cla-ts.com/team/ms-grace-lui

The information contained herein is for general informational purposes only and is not intended, and should not be construed, as legal, auditing, accounting, investment, or tax advice or opinion provided by CLA Global or any of its individual member firms to the reader. No client, advisory, fiduciary, or other professional relationship is established or implied between the reader and CLA Global or any of its member firms through the presentation of the information contained herein. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances or needs, and may require consideration of a number of other factors if any action is to be contemplated. Accordingly, the information presented herein should not be considered a substitute for the reader’s independent investigation and sound technical business judgment, and the reader is advised to contact his or her CLA Global member firm or other tax or professional advisor prior to taking any action based upon said information. Neither CLA Global nor any of its member firms assume any obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein.