Transfer Pricing: How Multinational Companies Can Use it to Manage Tariffs

With complex supply chains comes complex pricing and more scrutiny, presenting both risks and opportunities for multinational companies.

Transfer pricing and valuation determine the prices at which goods and services are exchanged between related entities within a multinational corporation. These prices influence the allocation of income and expenses across different tax jurisdictions.

One often overlooked aspect of transfer pricing is its impact on tariffs. Given the current global trade environment, consider how transfer pricing could be used as a tool to manage potential tariff impacts.

What is valuation and transfer pricing?

Transfer pricing refers to the pricing of goods, services, and intangible assets between related entities within a multinational corporation. Transactions should be conducted at arm's length, meaning the prices are comparable to those charged between unrelated parties.

Valuation, on the other hand, involves determining the value of goods and services for customs and tax purposes.

While income tax authorities are concerned the income earned within their jurisdiction is accurately reflected, indirect tax regulations involve customs duties, emphasizing the value of imported goods accurately represents all dutiable cost elements. Thus, appropriate transfer pricing policies are needed to balance both sides of the coin.

Valuation of tangible goods

Although there are similarities in the methods used to value tangible goods, customs authorities and income tax authorities have different objectives and goals. Customs authorities are responsible for verifying that the value of imported goods includes all dutiable costs and collecting the correct duties, which impacts a nation's revenue from imports.

Conversely, income tax authorities aim to verify the reported value of goods accurately reflects the income realized by companies within their jurisdiction, preventing them from understatement of income and paying less tax. These differing goals create inherent tensions and potential conflicts in the valuation process.

Strategic planning for intercompany transactions

Use strategic planning and appropriate documentation to help manage the complexities of globally integrated supply chains. They can also be used to price the intercompany transactions at arm’s length, satisfying both customs and income tax authorities. Consider measures to help manage risks and associated tax requirements.

Transfer pricing policies

Establishing robust transfer pricing policies aligning with both customs and income tax regulations provides consistency in the valuation of goods. Align such policies with local transfer pricing regulations to manage risks for both (or multiple) jurisdictions involved in the transaction.

Documentation and record-keeping

Maintain comprehensive documentation and records to substantiate the valuation methods used and demonstrate compliance with tax regulations. This can include:

- Transfer pricing documentation

- Local file

- Master file (as required)

- Intercompany agreements

- Invoices

- Purchase orders

Engagement with tax authorities

Proactively engage with customs and income tax authorities to seek clarity on valuation requirements and resolve any potential discrepancies. This includes options made available by the tax authorities such as advanced pricing agreements to set prices in advance and manage the risk of future audits.

Regular audits and reviews

Conduct regular audits and reviews of intercompany transactions to identify and address any inconsistencies in valuation practices.

Automate the adjustment process

To avoid year-end pricing adjustments, automate the pricing policy to help save time and effort and reduce errors.

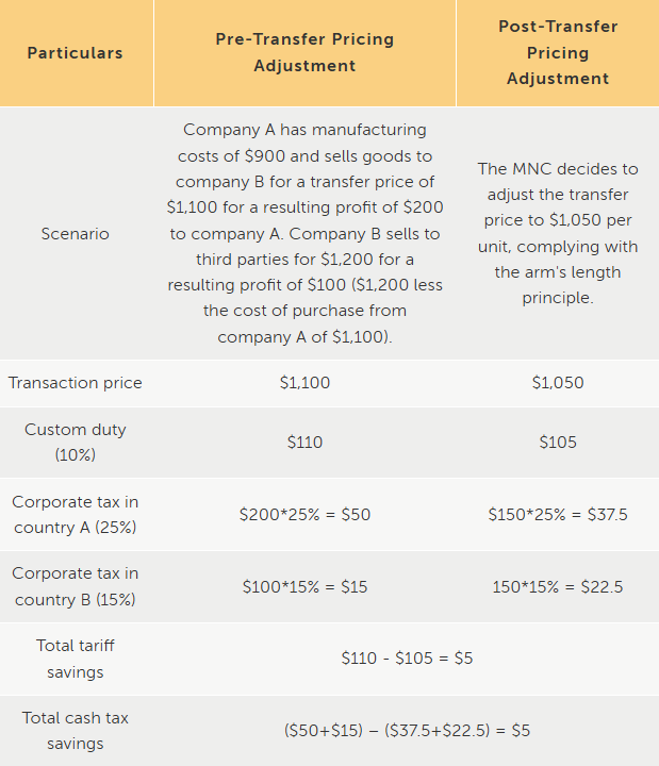

Transfer pricing example: Cash tax and tariff savings

Consider a simple example to illustrate the potential opportunities from adjusting transfer pricing.

Hence, by adjusting the transfer price, the MNC achieves a tariff saving of $5 and a cash tax saving of $5

How CLA can help with using transfer pricing to reduce tariffs

Transfer pricing and valuation play a crucial role in determining the customs value of imported goods and, consequently, the tariffs owed. By strategically adjusting transfer prices, multinational corporations can achieve substantial cash tax and tariff savings.

However, it’s essential to comply with both transfer pricing and customs regulations to avoid penalties and disputes. Proper planning and documentation are key to using these benefits while maintaining compliance.

For further information

Kyle Dawley

Principal

CLA LLP

https://www.linkedin.com/in/oliver-lohmar-579648213/

Paridhi Jaisingh

Manager

CLA LLP

The information contained herein is for general informational purposes only and is not intended, and should not be construed, as legal, auditing, accounting, investment, or tax advice or opinion provided by CLA Global or any of its individual member firms to the reader. No client, advisory, fiduciary, or other professional relationship is established or implied between the reader and CLA Global or any of its member firms through the presentation of the information contained herein. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances or needs, and may require consideration of a number of other factors if any action is to be contemplated. Accordingly, the information presented herein should not be considered a substitute for the reader’s independent investigation and sound technical business judgment, and the reader is advised to contact his or her CLA Global member firm or other tax or professional advisor prior to taking any action based upon said information. Neither CLA Global nor any of its member firms assume any obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein.